Editor's Message: Where Do You Get Your Wood?

Editor's Message: Where Do You Get Your Wood?

According to SBCA’s 2018 Financial Performance Survey, on average lumber accounts for 39.1 percent of the total cost of goods sold. Given the component manufacturing industry’s reliance on this raw material, SBC Magazine recently conducted two surveys of component manufacturers (CMs) to better understand who they buy lumber from and what grades they typically buy. Let’s look at what respondents said about their purchasing decisions.

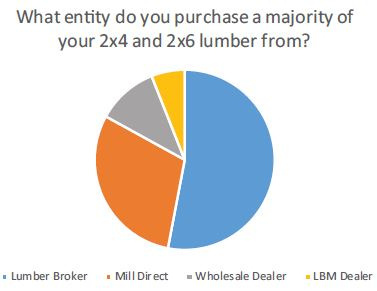

When asked who they purchase most of their 2x4 and 2x6 lumber from, 53 percent indicated they use a lumber broker, while 30 percent buy directly from a lumber mill. Another 11 percent buy their lumber from a wholesale dealer, and the remaining six percent buy from a lumber dealer or building material supplier.

CMs vary their purchase source only slightly for wide (2x8, 2x10 and 2x12) lumber, with lumber dealers or building material suppliers being the main source. Fifteen percent purchased from that group, while 45 percent still purchased from a lumber broker, 25 percent bought directly from the mill, and 15 percent went to a wholesale dealer.

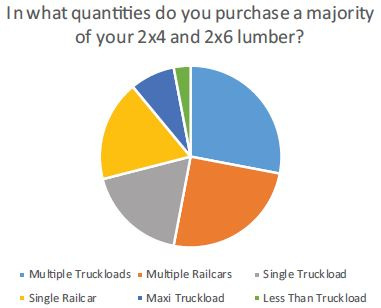

The survey also asked CMs the quantities they typically buy when making a lumber purchase. For 2x4 and 2x6 lumber, 28 percent purchase multiple truckloads at a time and 25 percent buy multiple railcar loads at a time. An additional 18 percent buy one railcar at a time and 18 percent by one truckload at a time. Another eight percent purchase lumber one maxi truckload (flatbed trailer + pup trailer) at a time, and only three percent bought less than a truckload at a time.

Not surprisingly, the quantities ordered at one time when buying wide lumber changed dramatically with only 13 percent buying multiple truckloads and eight percent buying multiple railcars. Instead, 33 percent bought one truckload at a time and 30 percent bought less than a truckload. Another eight percent bought one railcar at a time and eight percent bought one maxi truckload.

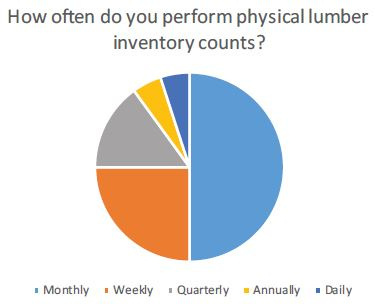

Finally, the survey shifted a bit to ask CMs how they track the lumber inventory they’ve purchased, both what they use to track it and how often they verify their inventory numbers. Most CMs have embraced the power of digital records, with 37 percent using Microsoft Excel or Google Sheets, another 37 percent using some other proprietary software like Epicor’s BisTracks or Inuit’s Quickbooks, and four percent using a bar code scanning system. Twenty percent of respondents rely on a paper-based system to track their lumber inventory, while one percent use an office whiteboard and one percent don’t track their inventory at all.

Fifty percent of respondents conduct a physical lumber inventory review once a month, while another 25 percent do it weekly. Fifteen percent said they do inventory once a quarter, while five percent are at either end of the spectrum doing it either annually or daily.

If you have additional insights to share on this topic or ideas for future polls, please let us know at editor@sbcmag.info.